Private Equity

Proprietary investment process

Through our proprietary sourcing and diligence processes we evaluate investment candidates over long periods of time, carefully gauging risk reward levers, while ensuring alignment of interests amongst all stakeholders. We solely pursue exclusive and proprietarily sourced transactions with amicably engaged counterparties seeking mutually beneficial results.

Value acceleration

We invest in high quality businesses where we can help catalyze growth and transformation in key areas of value, driven by our strategic insight, operational support, and international relationships.

Long term outlook

We acquire durable businesses, with successful operating histories and experienced management teams that have an articulated long-term vision for the future of their industries. We seek exposure to industries facing favorable operating environments with secular growth trends and companies which have built robust balance sheets and defensible business models.

Mold making factory, a unit of Zeno Partners’ majority owned portfolio company, Vangest

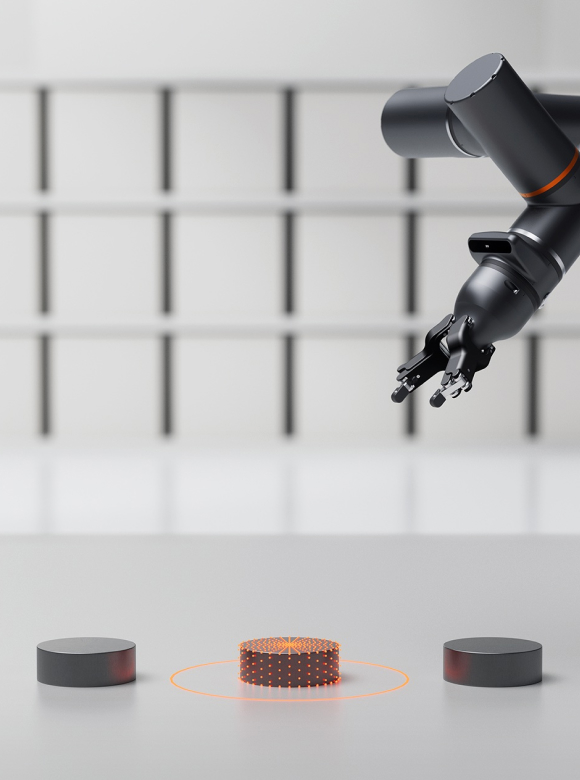

The RO1 robot, a product of Zeno Ventures’ portfolio company Standard Bots.

Zeno Ventures

Backing exceptional teams

We invest globally into founder driven, product-centric businesses, built by exceptional individuals who are changing industry through persistence and sheer will. Our job is to find and support the most talented entrepreneurs solving the world’s most challenging and interesting problems.

Funding tomorrow’s companies today

Our companies leverage technology to create sustainable advantages within a broad array of sectors, while displacing incumbent businesses and creating entirely new product categories.

Going the distance

We seek to initiate our investment in companies at the early stages, while following their development with additional capital at key inflection points during their path to maturity. By backing our companies throughout their lifecycle, we build strong relationships while realizing capital growth alongside the founders that are transforming the global economy.